The controversial new “school tax” imposed by the B.C. NDP government on homes valued above $3 million has been met with outcry among a group of owners saying they are “house rich but cash poor” and cannot afford the taxes out of their household incomes. This has prompted responses from those unsympathetic to their situation, who suggest the owners simply defer the payment of the taxes, which is permitted for seniors or families with children.

Some of the homeowners have replied that they don’t want to pass the tax burden on to their children who would inherit their homes and be forced to pay all the accumulated taxes, plus interest.

So, for those who are eligible to defer, exactly how much would deferring the school tax cost the homeowner? Would the taxes and interest compound to become astronomical?

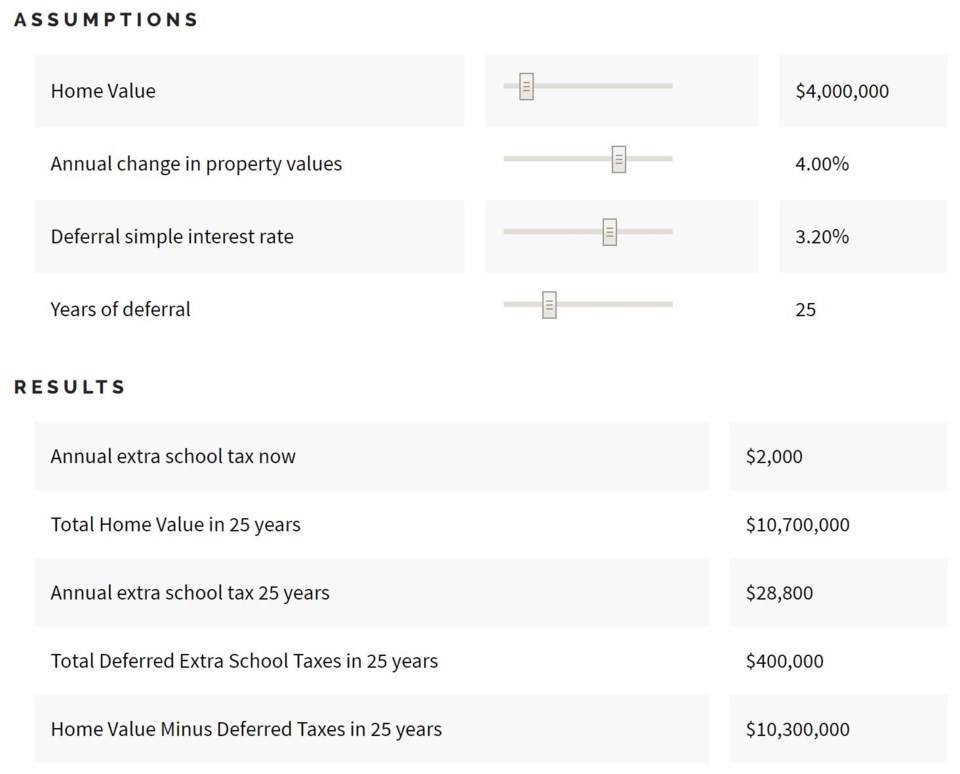

Jens von Bergmann, a data analyst known for his home value heat maps, has come up with an interactive online calculator that lets users – or other interested parties – work out exactly what total tax bill they’d end up with. It allows for variations in initial home price, the rising annual value of the home (if any), the number of years deferred and the interest rate applied. Seniors are eligible to defer at a simple (non-compounding) interest rate of 1.2 per cent, whereas families with children, and those who are eligible under hardship circumstances, pay 3.2 per cent.

The below example is for a family with children deferring taxes for 25 years on a (currently) $4 million home, which rises in value by four per cent a year over that time period.

The calculator finds the owner hit with a $400,000 tax bill – but the $4 million home is by the end of the 25 years worth $10.7 million. In response to such scenarios, Bergmann says, “I find it hard to relate to how this could constitute any form of cruel hardship.”

A significant loss of money from tax deferral only arises when home values don’t increase. According to the calculator, in the unlikely event that home values were to remain the same in that 25-year period, the owner of the home in the above example would be hit with a $69,000 tax bill, which would have to come out of the sale of the home that is still worth $4 million. The tipping point is an annual home-value increase of 0.2 per cent, above which the home owner still makes money.

Remortgaging problems

However, it’s not just about the tax bill, as B.C. notary and real estate economics academic Ron Usher told CKNW’s Linda Steele Show in late May. Usher observed that home owners remortgaging every five or so years may have problems with their lenders, as the tax deferral would be considered another loan that must be accounted for in the owner’s financial portfolio. Usher said this is contrary to most lenders’ rules, and they might require the owners to pay off the tax bill in full, using money from the refinancing of their home. This in turn would mean owners paying a lot more in interest rates over the long term than the B.C. government’s deferral interest rates.

“There are other times [a tax deferral] might cause issues for you – for example, if you ever need to take another mortgage out, if you ever need to get a reverse mortgage or if you need to get a line of credit to do the repairs on your house… Every mortgage lender I know requires that a government tax lien has to be fully paid out.”