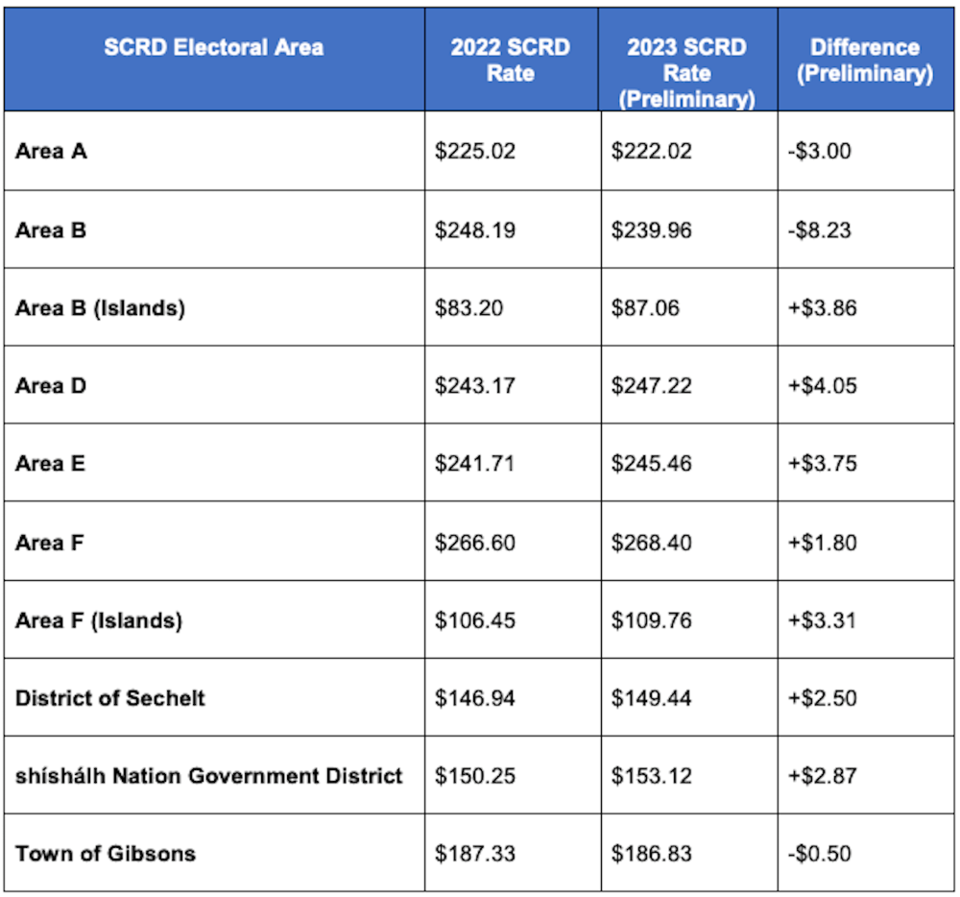

2023 general property tax rates from the Sunshine Coast Regional District (SCRD), showing increased rates for all but three areas, were released on March 20.

The rates are reported in dollars per $100,000 of assessed property value, and this year they range from $87.06 to $268.40, depending on the area the property is located in. They are slated to increase over 2022 rates by $1.80 in Area F (Howe Sound) and $4.05 in Area D (Roberts Creek). A $3.86 increase is projected for island properties in Area B (Halfmoon Bay). Area E (Elphinstone) will see a $3.75 rate hike and Area F Island properties will see rates go up by $3.31. The rate for District of Sechelt parcels will be $2.50 higher and the increase for those in shíshálh Nation Government District will be $2.87.

Properties on the peninsula in Area B will see an $8.23 decrease in their tax rate compared to 2022. Rates are also going down in Area A (Pender Harbour) by $3 and in the Town of Gibsons, they will be $.50 lower than last year’s rates.

Residents can calculate their proposed SCRD portion of their tax bills by dividing the assessed value of their home (found at www.bcassessment.ca) by $100,000, then multiplying that by their electoral area’s amount.

The adjusted rates, combined with updated assessed values will translate to higher numbers on the SCRD general taxation line of this year’s property tax notice for most Coast property owners. Impacts on individual parcels will vary depending on changes to assessed property values.

According to a staff report on the March 23 board meeting agenda, tax rates will be finalized following that meeting. Also on the meeting’s agenda is consideration of adoption of the organization’s five-year financial plan bylaw. That document cites operating expenses (including amortization) of $58.4 million this year, up from $53 million in 2022.

In the release, the SCRD identified the main drivers for taxation as more than $5 million dollars of investment in recreation facilities, including roof replacement for the Gibsons and Area Community Centre, and inflationary pressures affecting the large number of projects moving forward as well as costs for operations and maintenance for all the services it provides. The local government invites questions about its 2023 financial plan at letstalk.scrd.ca/budget.

Regional hospital tax rates increasing

Meeting as the regional hospital district board, also on March 23, local elected officials will consider a six per cent increase in 2023 tax rates to fund that entity’s operating budget of $2.74 million for this year. Property taxes are slated to cover $1.52 million of that spending. The proposed residential tax rate is $6.63 per $100,000 of assessment. That rate in 2022 was $6.24, which generated $1.28 million.

A staff report on that meeting’s agenda explained that the tax rate increase is required to offset loan repayment costs related to higher interest rates for the long-term debt. In 2023, those are projected to be $583,000 compared to $356,000 in the previous year. It also noted that the rate may be "slightly adjusted" in April when the assessment role values are finalized.