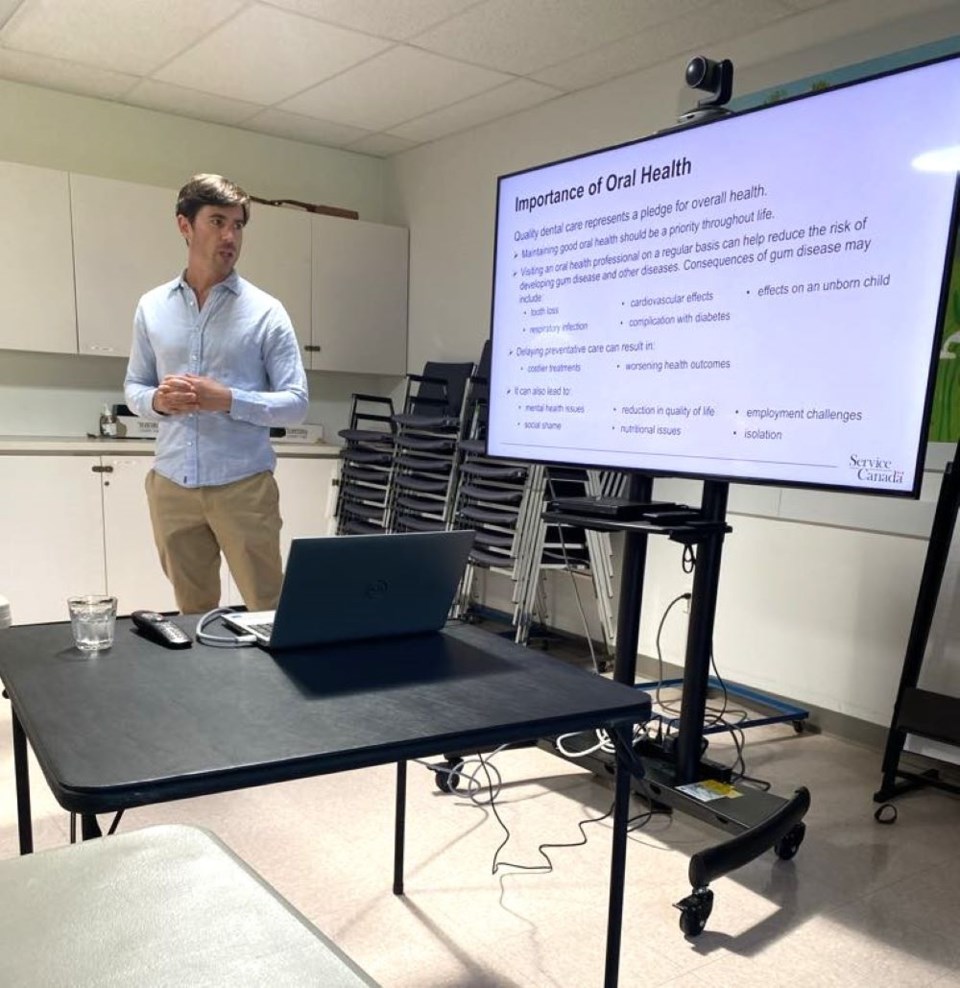

Patrick Weiler, Liberal MP for the West Vancouver-Sunshine Coast-Sea to Sky, was on hand at the Sechelt Seniors Activity Centre July 11, for an information session on the Canadian Dental Care Plan (CDCP).

Weiler started with a short presentation and then answered questions from the small group in attendance, several who had concerns about the roll-out of the plan. Weiler noted to date, 2.1 million seniors have been approved for coverage under the plan. He added as of July 8, all dentists were enroled in the program, so no longer need to register themselves.

Several participants attending the information session had questions about how to access the new service — and said they were unfamiliar with computers — so Coast Reporter has broken down some of the most frequently asked questions, which will hopefully help.

Once you've been approved and apply, it takes up to three months to receive a welcome package, which should include you card and a fee guide. You can also give your dentist office a call and tell them you’re on the plan before you arrive.

What is the Canadian Dental Care Plan?

With oral health finally recognized as a key component of overall health and well-being, the federal Liberals, with more than a little prompting from the NDP, introduced the plan in 2022, to provide dental coverage for low-and middle-income Canadian residents who previously didn’t have access to benefits.

- The estimated cost is $13 billion over five years and $4.4 billion each year following.

- The plan is administered by Sun Life and managed by Health Canada.

Who qualifies?

- Residents with no access to dental insurance

- Residents with a family income of less than $90,000

- You have to be a Canadian resident who filed their income tax in the previous year

- Canadian residents who have access to dental benefits through a social program offered by their province or territory and/or by the federal government if they meet certain criteria.

- If you’re eligible for dental coverage through your workplace, professional or student organization, but choose not to take it or use it, you’re not eligible for the CDCP. If you qualify, your coverage will be coordinated between the plans to make sure there are no duplication or gaps in coverage.

Who is eligible now?

(For those who qualify for the plan)

- Seniors aged 65 and older

- Children under the age of 18

- Adults with a Disability Tax Credit

- All other eligible Canadians can start applying in 2025

How to apply

To complete the application, you’ll need to provide the following information for each applicant and your spouse or common-law partner (if you have one):

- Social Insurance Number (SIN) (if available for children)

- Date of birth

- Full name

- Home and mailing address

- List of dental coverage you have through government social programs (if any)

- You and your spouse or common-law partner (if applicable) must have filed your tax return for 2023 and have received your Notice of Assessment

You’re encouraged to apply online. If you can’t apply online, you can do so by phone by calling 1-833-537-4342. Remember to submit one application for everyone who qualifies to prevent delays.

What’s covered?

- Preventative services, including cleaning, polishing, sealants and fluoride

- Diagnostic services, including exams and x-rays

- Fillings

- Root canals

- Complete and partial removable dentures

- Periodontal services, including deep scaling

- Oral surgery, including extractions

You can find a full list of services at canada.ca/en/services/benefits/dental/dental-care-plan/coverage.html

How is the plan broken down by income?

Adjusted family net income:

- Below $70,000: 100%

- $70,000 - $79,000: 60%

- $80,000 - $89,999: 40%

Additional charges may apply if:

- The CDCP fees may not be the same as what providers charge. You may have to pay fees in addition to the potential co-payment if:

- The cost of your oral health care services is more than what the CDCP will reimburse for these services

- If you agree to receive care that the plan doesn’t cover

Before receiving oral health care, you should always ask your oral health provider about any costs that won’t be covered by the plan. Make sure you know what you’ll have to pay directly to your oral health provider ahead of receiving treatment.

What happens if a dentist charges a higher rate than covered by the plan?

- Weiler said that amount should not be more than 8%

- So, if a procedure is covered up to $100, but you’re charged $108, you’ll be responsible for the extra $8

- Ask your dentist ahead of any procedure to find out what your cost will be

What happens if a dentist says you have to pay them first and then get reimbursed?

- It’s simple. You will not get that money back.

- Weiler made it very clear the plan was developed so residents who qualify never have to pay upfront – with the exception of any amount you’re required to. For example, if you qualify for 60% coverage, you’ll be expected to pay that extra 40% at the time of your visit.

How do I find a dentist who accepts the plan?

- Weiler said as of July 8, every dentist in Canada was automatically enroled into the program, so there’s no longer any need for them to sign up.

- It’s always best to call and ask before you go, in order to clarify how much your dentist knows about the plan.

- And, don’t forget, if your dentist says you have to pay upfront, they’re wrong and you will not get that money reimbursed

- You can also search by area using this handy tool.

Complex dental services need pre-authorization

- Some of the more complex dental services — such as partial dentures and crowns — require federal pre-authorization of payment

- Pre-authorized services won't be covered until November 2024

- Orthodontic services that will improve oral health outcomes for eligible clients, become available beginning in 2025.